Global alcohol industry loses billions as Gen Z reshapes drinking & social habits

Bloomberg data shows US$830 billion loss in market value, while the Night Time Industries Association reports young adults moving away from traditional nightlife

Global drinking habits are undergoing a measurable decline, with significant financial and cultural effects across the alcohol industry and nightlife economy.

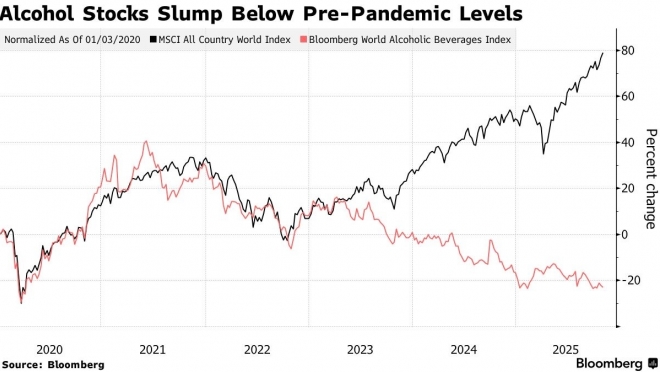

According to Bloomberg data shared in late October 2025, shares in the world’s largest beer, wine, and spirits producers have lost a combined US$830 billion in market value over the past four years.

As a result, a Bloomberg index tracking around 50 drinks companies now sits 46% below its June 2021 peak.

Analysts point to a structural shift in consumption. “There is a structural change going on—people are drinking less,” said Sarah Simon, an analyst at Morgan Stanley.

Bloomberg attributes the downturn to changing consumer behaviour, rising health awareness, higher interest rates, commodity price pressures, plus regional factors such as China’s ban on alcohol at official functions.

“We’ve seen four times the impact of the financial crash on alcohol consumption,” said Laurence Whyatt of Barclays, who added that growth rates seen in previous decades are unlikely to return.

The decline is particularly pronounced among Gen Z.

As show in an article by NDTV Food Awards, multiple consumer surveys indicate that a significant share of Gen Z adults either drink less often, choose moderation, or opt for alternative beverages.

For example, about 21.5 % of Gen Z do not consume alcohol at all, and another 39 % drink only occasionally, suggesting a large segment prefers moderation or little to no drinking overall.

Read this next: 69% of Gen Z use drugs "daily or weekly" to cope with work stress

Though legal-age Gen Z is drinking more in some markets (66% to 73% participation), their frequency, category choices, and volumes still don’t mirror older generations.

Early indications of a shift in drinking culture emerged in 2018, according to World Finance. In 2023, the publication cited a Berenberg Research study that documented changing alcohol habits across generations.

Read this next: Sadiq Khan's Nightlife Taskforce share 23 recommendations for London's night-time economy

The study found that Gen Z drinks 20% less per capita than Millennials, who themselves consumed less alcohol than Gen X and Baby Boomers at the same age.

According to the Night Time Industries Association (NTIA), Gen Z is not only drinking less but is also socialising differently, with digital platforms increasingly replacing in-person gatherings and reducing reliance on traditional nightlife venues.

Read this next: VibeLab launches The Nighttime Foundation to support nightlife communities worldwide

When Gen Z does go out, preferences tend to favour experience-led events over alcohol-centric settings. This shift aligns with a stronger emphasis on wellness, as well as the growing role of technology-driven delivery and ordering services.

At the same time, the demand for no- and low-alcohol options has prompted an industry-wide response, alongside leadership changes across major alcohol producers.

Amira Waworuntu is Mixmag Asia’s Managing Editor, follow her on Instagram.

Cut through the noise—sign up for our weekly Scene Report or follow us on Instagram to get the latest from Asia and the Asian diaspora!